Patent owners or investors - how to improve your strategic position against your competitors.

February 4 2019 Patents are both a tool to protect new developments, and for large and sophisticated corporate companies, a strategic tool to improve their competitive position - and the same applies to companies that invest in patents for the primary purpose of licensing them.

These principles are well understood among sophisticated patent owners, but turning these principles into practice is always the challenge. This is particularly so in the areas of technology that can have the greatest value, where there can be thousands, or even hundreds of thousands, of patents already filed. In some cases, acquiring high quality patents filed by other companies may be an answer to this challenge.

For this reason, when we speak to patent analysts working for sophisticated patent owners, one of the questions we sometimes get is:

How can we find patents that we can acquire that would improve our competitive position with respect to our key competitors?

The AI power patent searching database Ambercite can greatly assist this process, as will be shown below.

Case study - Apple Ear Buds

Apple earbuds are becoming increasingly popular, being a clever combination of wireless in-ear speakers and an integrated microphone.

Now imagine you were a competitor to Apple, or a company wanting to build up a IP position in this technology space, in particular a position that would improve your strategic position against Apple. How might you do that?

Using Ambercite Ai, this can be quite straightforward. To demonstrate this, we firstly ran a search in a conventional patent search database for patents that were owned by Apple, and that referred to ear buds and wireless in the title or abstract. We found 64 relevant patent families*, and then used these patents as the basis for an Ambercite search.

*Note that there are many ways we could run such a query, and different queries will produce different results. But this is not a blog about conventional patent searching.

The box above only shows a partial list of the patent numbers entered. Note that we ran a “Licensing Search”, and limited results to those with priority dates in the last 15 years.

This particular query returned 1000 results as requested, with 175 of these patents owned by Apple.

But we might be a little selective in our analysis, perhaps filtering out those patents owned by Apple:

Also, from experience, we might request a minimum Similarity score in the results of 2. Similarity score is a metric developed by Ambercite to predict the similarity of patent families found to the query patent. A higher Similarity score predicts a greater similarity, and a value of 1 or 2 generally predicts a likelihood of 2 patents being similar.

Applying these two filters leaves 514 similar patents to review. 514 patents may sound like a lot, but this is not nearly as bad as it sounds, for reasons to be explained below,

How to efficiently review patents in Ambercite

Take a look at the remaining results as shown below (an interactive link to these results is found here)

These patents are ranked in order of similarity, and the these patents all seem to be relevant to in ear headphones .

But if a competitor was looking to acquire patents in this space, they might choose look for patents not owned by large companies.

In 7th position in this list is US9148717, as shown below in a Patent Review Panel. To open such a Patent Review Panel, simply click on any image or Title/Abstract box. You can then easily and efficiently scroll through the results.

There are also a good number of patents filed by a German company called Bragi, with one of these patents shown below:

While a little further down the list, I came across this interesting patent, which is owned by Think a Move, a smaller company in this area.

Of course, not all results in this list are relevant, and some are abandoned or rejected patent applications. Regardless, a skilled patent analyst can find a treasure trove of potential patent acquisition targets in this list.

A Macro-view - Licensing Potential profiles

Each of the above patent families is listed with a value for “Licensing Potential”. The Licensing Potential metric combines information about the similarity of the patent family, and its predicted importance, and again a higher value is better.

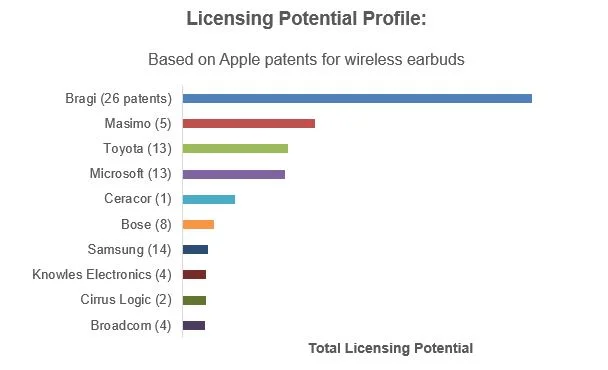

If a patent owner has multiple patents in this list, the Licensing Potential values for these patents can be added together. An easy way to do this is to export the results into Excel, and then use Pivot Tables or other tools in Excel, you can create the following Licensing Potential profile:

Top of this list is Bragi (see more about them below). Second place Masimo makes medical monitoring equipment, and may be not completely relevant. Perhaps surprisingly, Toyota is - they have patented wireless headpieces. Some of the Microsoft patent were also relevant, along with patents filed by Bose, Samsung, Knowles Electronics, Cirrus Logic and Broadcom. There are also other 407 patents on this list of results not filed by the above companies.

More about Bragi

Bragi had so many relevant patents in the results, I wondered if they were somehow linked to Apple. But in fact, they were selling competing in ear microphones or least until were until very recently, as discussed in this news article, published just yesterday.

This says they have sold their product portfolio, and have now transformed “into a software, AI and IP licensing company”.

Which made me ask - What would a Licensing Potential profile look like for Bragi’s ear piece patents?

I ran this analysis using a very similar process to that discussed above, and to no surprise at all, Apple were right at the top of the list of potential licensing partners for their patents. It looks like Bragi were outsold in the marketplace, and so instead they will focus on monetising their IP portfolio instead.